pay estimated indiana state taxes

Indiana state filing information for tax-exempt organizations. On average the nations estimated 11 million undocumented immigrants pay 8 percent of their incomes in state and local taxes every year.

Dor Keep An Eye Out For Estimated Tax Payments

Unfortunately the Tax Cuts and Jobs Act limits this itemized deduction to 10000 for tax years 2018 through 2025 and to just 5000 if youre married and filing a separate return.

. Paying your state. Employers engaged in a trade or business who pay compensation Form 9465. But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file.

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. See IRSgov for details. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

You wont need to pay MI state taxes if you work there but live in IL IN KY MN OH or WI. Youll find state-specific instructions are generally easy to. Its estimated that as many as 42 of Americans worked.

Find Indiana tax forms. Pay my tax bill in installments. Know when I will receive my tax refund.

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. If your state collects income taxes youll need to also make a state estimated tax payment. Installment Agreement Request POPULAR FOR TAX PROS.

Every state has different requirements for this but its usually also quite painless. Please note that you will only get a tax credit for your IL state income taxes up to the amount of IN state income taxes that would have been paid if the income was earned in IN. Another deduction you can take on your federal return to try to nip away at your tax bill is for the income taxes you must pay to your state on your winnings.

You wont need to pay AZ state taxes if you work there but live in CA IN OR or VA. Indiana Oregon and Virginia. Take the renters deduction.

Claim a gambling loss on my Indiana return. The credit for taxes paid to another state section will be at the end of your residence states interview process. If you dont find the form you need on this page visit the Miscellaneous Individual Forms page.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Usually thats enough to take care of your income tax obligations. Have more time to file my taxes and I think I will owe the Department.

Prior year tax forms can be found in the Indiana State Prior Year Tax Forms webpage. If you do not wish to pay your estimated taxes by credit card or ACH e-check scroll down to complete and mail Form ES-40 along with your check. Minnesota has an agreement with Michigan and North Dakota.

While it is unlikely to happen in the current political environment undocumented immigrants state and local tax contributions could increase by up to 21 billion under comprehensive immigration reform.

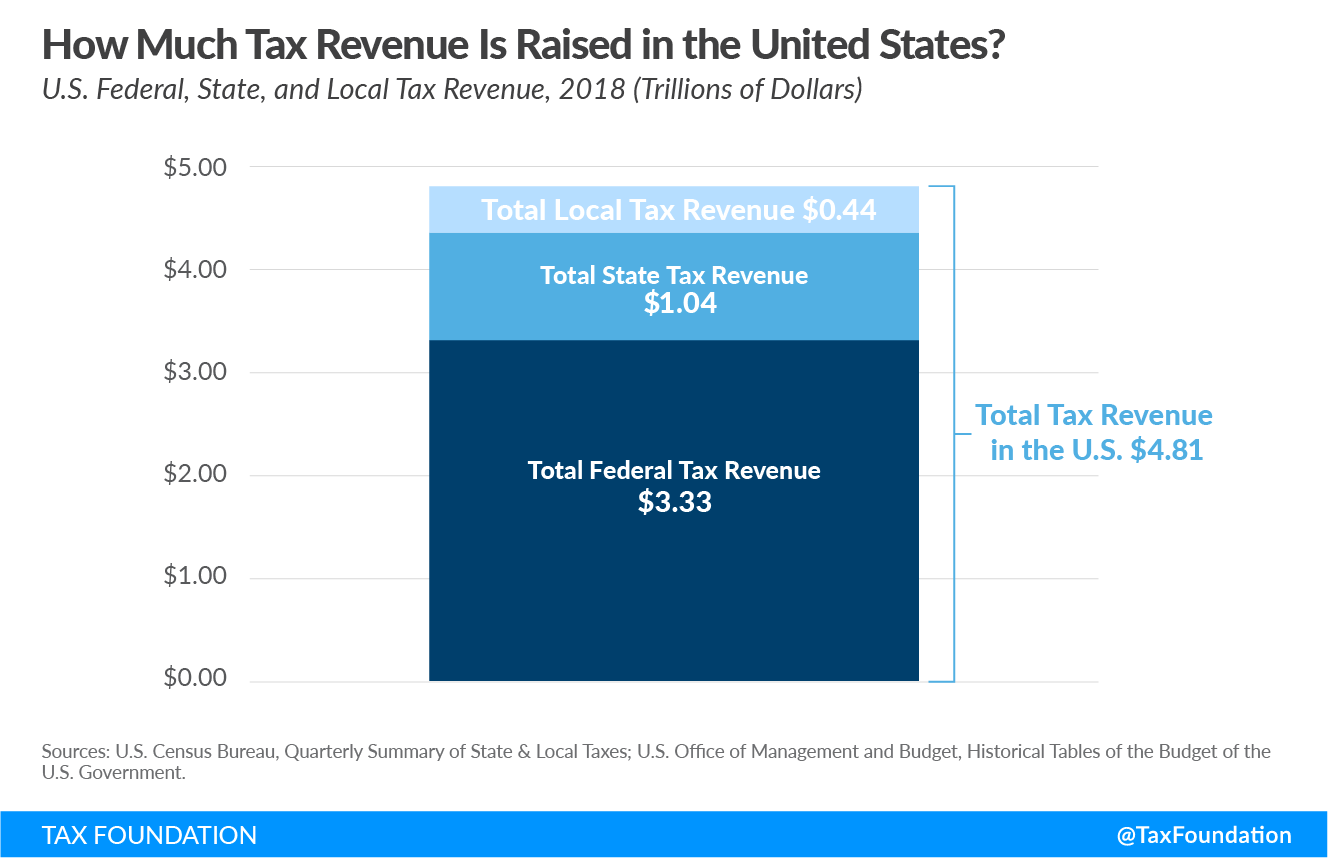

Government Revenue Taxes Are The Price We Pay For Government

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Where S My State Refund Track Your Refund In Every State

How Do State And Local Sales Taxes Work Tax Policy Center

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Taxation Of Social Security Benefits Mn House Research

Dor Owe State Taxes Here Are Your Payment Options

Indiana Sales Tax Small Business Guide Truic

Dor Owe State Taxes Here Are Your Payment Options

Tax Burden By State 2022 State And Local Taxes Tax Foundation

States Vary Widely In Number Of Tax Filers With No Income Tax Liability Tax Foundation

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

How High Are Capital Gains Taxes In Your State Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)